National Insurance Refund Potential for Your Business: What You Need to Know

In the ever-evolving tax landscape, businesses must be aware of potential opportunities that can benefit both the company and its employees. One such opportunity lies in the realm of National Insurance Contributions (NICs). If your business provides car allowances and pays mileage allowances at a rate less than 45p per mile, there's a significant chance you could be eligible for a refund on NICs.

The Opportunity at a Glance

If you qualify in previous years, you will have a refund claim, which could be substantial.

Even if you didn’t qualify in the past, you can structure your affairs to qualify going forwards, each time you pay your employees.

In either case, it’s a win-win situation for both the company and employees, as both benefit.

A Glimpse into Potential Refunds

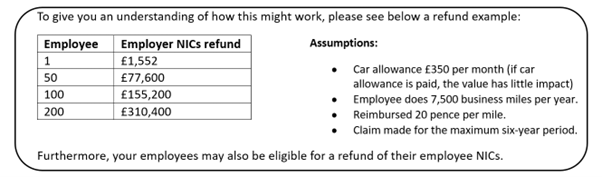

To provide a clearer picture of how this refund might benefit your business, consider the following example:

How Dains Can Assist

At Dains Accountants, our commitment is to ensure that businesses navigate the complexities of finance with ease and confidence. Our team of experts is equipped to determine the feasibility of your NICs refund claim and will meticulously structure it to maximise your chances of repayment from HMRC.

If you're keen to explore this opportunity, we're here to guide you every step of the way. Whether you're already associated with us or are new to Dains, our Employment Taxes Specialists are ready to assist.

Simply complete our online enquiry form or call 0800 298 3899.

While the intricacies of the UK tax system can sometimes be overwhelming, opportunities like the NICs refund can offer significant financial relief. Don't let such chances slip by. Reach out to Dains today and let us help you make the most of it.

Latest News