Results from the latest BCC survey on the impact of Coronavirus on businesses show they have been pushed to the brink by the effect of multiple lockdowns.

Among the sobering findings from the survey of more than 1,100 businesses are:

- Three in every five firms (61%) have seen their revenue from UK customers fall in the last three months

- Almost a third (31%) of business-to-consumer (B2C) firms say they will run out of cash in the next three months

- A quarter of survey respondents (25%) say they will make staff redundant if financial support stops in March and April.

The leading business group has called on the UK government to set out a clear roadmap for reopening, advancing vaccination and workplace testing plans, and extending key financial support measures for businesses throughout 2021.

Business conditions worsen

Compared to October 2020, 61% of firms reported decreased revenue from UK customers. Only 19% of firms reported increased revenue and 20% reported no change. B2C service firms are significantly more likely to report decreased revenue (74%) from UK customers, as are firms with less than 10 employees (65%).

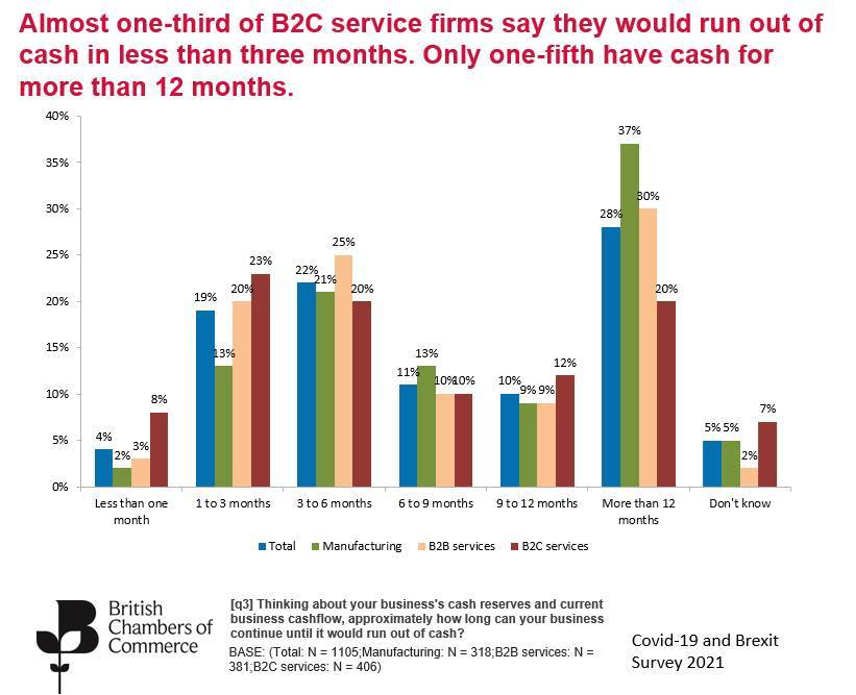

When asked approximately how long firms could continue until they ran out of cash, almost one-quarter (23%) said less than three months. This figure rises to almost one-third (31%) of B2C service firms. Just over one quarter (28%) of firms overall and only one-fifth (20%) of B2C firms have cash for more than 12 months.

The results paint a bleak picture of a business landscape which has been severely squeezed by repeated lockdowns and massive changes in trading conditions. The survey results also suggest that without the huge amount of government support given to companies to date, that business failures and job losses could have been much worse.

Crucially, more support is needed until firms can fully reopen, with just over a quarter (28%) of businesses indicating they have enough cash to last more than a year. On average, B2C firms are currently operating at only 42 per cent of full capacity, while all firms were averaging 57% capacity against a pre-pandemic level of 75 to 80 per cent. Almost half (48%) of companies reported they still have staff on furlough.

Rating the support from government

When asked to rate the effectiveness of the various government schemes to support their business throughout the crisis, the Coronavirus Job Retention Scheme (CJRS), allowing firms to furlough staff, had by far the highest effectiveness rating. More than two-thirds (68%) using this scheme say that it has been very effective, with a further 28% rating it as somewhat effective. Only 4% said it was not effective.

Other schemes with high effectiveness ratings included Government loan schemes (such as CBILS and BBLS) where 46% rated them ‘very effective’ and 44% rated them ‘somewhat effective’, and the local authority business grant scheme, where 45% rated it ‘very effective’ and 40% rated it ‘somewhat effective’. Business rates relief (49%), VAT deferrals (34%), VAT cuts for certain sectors of the economy (26%) were also rated as very effective.

What firms may do if support expires in March and April

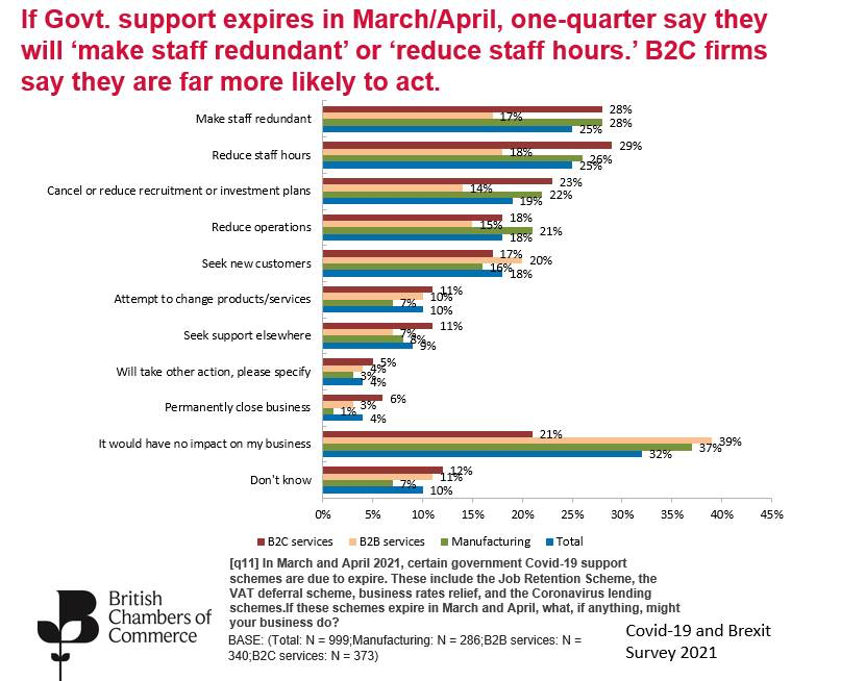

When asked what their business might do if the government support schemes end according to published timetable in March and April, 25% of firms overall said they would ‘make staff redundant’, 25% would ‘reduce staff hours’ and 19% would ‘cancel or reduce investment or recruitment plans’. Only 21% of B2C firms said the expiry of support ‘would have no impact on their business’, compared with 39% of B2B firms and 37% of manufacturers.

Responding to the survey results, BCC Director General Dr Adam Marshall said:

“The last year has taken a heavy toll on businesses across the UK. With cash flow still the top concern, it is vital that the UK government keeps financial support going until firms can reopen and rebuild. Pulling the plug now would be a huge mistake, and would be akin to writing off the billions already spent helping firms to survive.

“Firms are desperate to start trading again so they can boost revenue and start thinking about the future. To do so they need to see a clear, evidence-based plan for reopening, and they need time to get back on their feet without unnecessary additional taxes, and the security of knowing that Government will once again support them should we see additional restrictions imposed at any point.

“In the meantime, support must remain in place for firms that need it until a full reopening of the economy is possible. With cashflow being a major challenge for many businesses, we can expect to see further redundancies or business failures should Government support end prematurely.

“Alongside a clear roadmap for reopening, business confidence will also come from a commitment to further accelerate the vaccination programme and a wider workplace testing strategy that’s accessible to businesses of all sizes.”

Business views on financial support

Philip Miller, company director of the Stockvale Group, which operates the Adventure Island fun park, Sealife Adventure and several restaurants in Southend-on-Sea, Essex, said:

“Overall, I am very impressed with the Chancellor who went above and beyond on support measures for small businesses - with measures such as the job retention scheme, expanding business rates relief, grant support and VAT reductions and deferral all being great aids for helping my businesses to deal with the challenges of the pandemic and the subsequent lockdowns. This encouragement was an absolutely vital lifeline that helped us deal with the falls in revenue and strain of going through three lockdowns.

“One of the main problems we faced as a business was having to spend vast amounts of money making our businesses Covid-proof, just to be told that we had to remain shut. This was a terrible hit and, in general, the stop and start nature of the restrictions has been one of the most difficult aspects of dealing with the pandemic so far

“Going forward it is necessary for the Chancellor and the Government to provide businesses with more clarity and certainty, not just on coming out of the lockdown and when we can trade again, but also in terms of what support measures will be extended and expanded. If the chancellor was to announce any help measures going forward it would encourage businesses like mine to keep borrowing and or just keep going. I'm sure it would encourage banks to be more supportive as well. Knowing what is coming next is vital.”

Greg Majchrzak, managing director of Tufcot Engineering Ltd, in Sheffield, said:

“We feel as a company that the Government support so far has been excellent towards not only manufacturing but most companies across the whole UK.

“Without the furlough scheme we would certainly have been planning redundancy reviews on a larger scale but due to the support we managed to keep redundancies to the bare minimum.

”Tufcot only required the furlough scheme and apprentice support, and we coupled this with a working from home schedule for all office staff. All of our employees were on board with the above approach and I’m sure they all appreciated that they got 80% of their wage instead of what would have inevitably been a redundancy review and job losses.”

Fieldwork for the poll was conducted between 18 and 31 January 2021

A total of 1,115 firms responded, with 29 per cent manufacturers, 36 per cent B2C services firms and 34 per cent B2B services firms

The BCC has established a Coronavirus Hub with the latest guidance and information to support businesses. You can find it here.

The BCC is calling on the government to:

1. Provide a clear plan for reopening the economy by:

a. Giving real clarity on the key metrics and triggers for moving into lower restrictions

b. creating a sequenced list of sectors/businesses to reopen

c. providing a credible plan with milestones for reopening schools, both primary and secondary.

d. giving businesses notice about when changes will happen, allowing them to prepare for them.

2. Protect jobs and livelihoods by:

a. Extending the job retention scheme until a full reopening of the economy is possible and at least until the end of July 2021

b. Expanding income protection support for directors of limited companies by extending the self-employment Income Support Scheme (SEISS) to cover company dividends as well as PAYE salary

3. Support business’ cashflow by:

a. Extending business rates relief for businesses in the retail, hospitality and leisure sectors and make available to businesses in more sectors for another 12 months

b. Offering immediate and more significant cash grant support at least equivalent to levels of around £25,000 available in the first national lockdown

4. Keeping the economy moving

a. Vaccinate by working closely with companies across the UK to accelerate the rollout of vaccines, using their space, capacity and people as much as possible

b. Improve the Test, Trace and Isolate system to keep the economy moving once the current lockdown ends

Latest News